Danielle Bejr

Danielle Bejr

Preparing to retire causes mixed emotions for many people. You might feel pride and joy for what you have achieved in your career or fear and uncertainty about what life will bring next. These feelings are valid and important no matter what you feel as you begin to explore retirement.

At Elite, we work with people at every stage of their careers to build solid foundations from which they can make informed decisions about their next step. From their very first job to navigating career change and parental leave, and finally, to retirement. Whether you are considering a definite date you stop work or planning a gradual retirement, let us support your plans by discussing the financial, mental and practical activities you can do to be prepared.

Retiring comes with considerable financial implications but let me be upfront – at Elite, we are many things, but one thing we aren’t is Financial Advisors! While the information and resources we provide here are general in nature and a great starting point for the financial side of retirement, we strongly recommend that you seek professional, accredited and personalised financial advice before making any financial decisions.

You’ve worked hard in several roles and possibly multiple companies for a good portion of your life, making deposits into a retirement or superannuation fund. Now, instead of relying on a weekly or fortnightly income, you’ll need to adjust your everyday budgeting to draw on a range of different income streams, which could include:

MoneySmart is an Australian government division that helps you understand the different financial aspects of retirement. We highly recommend using their retirement website as a starting point to consider your financial needs.

Picture getting up late without an alarm, shopping during daylight hours, and free evenings for fun and family – for many, this image of retirement is fantastic! However, research of people who have recently retired shows that it is vital to have some idea of what your day to day will look like to ensure you feel your life continues to have purpose and meaning outside of contributing to a paid position. We’ve put together three quick tips to help you think about how to prepare for retirement!

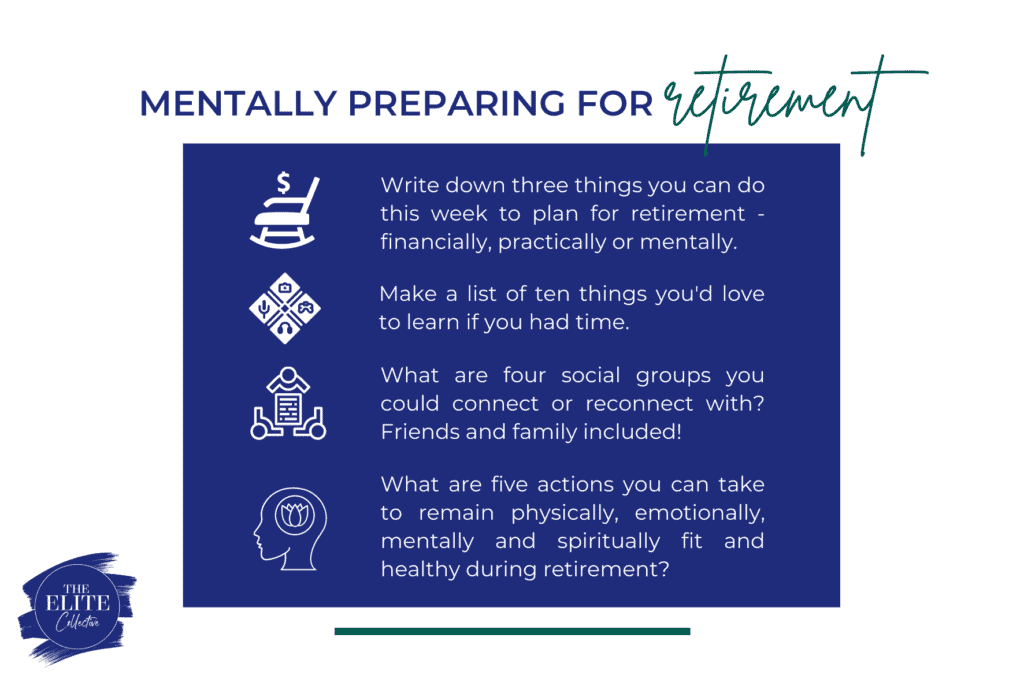

We mean it. Get talking to others who have retired, speak to a financial advisor and start setting some goals for what you want to do with your time. You may find that now could be the perfect time to take that plunge – or perhaps you’d like to spend another few years considering the practical elements of retiring before you choose to do so. Write down three things you can do this week to start planning for retirement.

People who enjoy their jobs do so despite ups and downs because it keeps them on their toes and they have a great team to work with. A great way to continue to feel challenged, engage your problem-solving abilities and share a commonality with others is to learn something new. This could be a new practical skill such as woodwork or gardening, or an experience like working with children or coaching a sports team. Make a list of 10 things you’d love to learn if you had the time.

Family, friends, the local art centre or footy team – it doesn’t matter who or where they are; connecting with a new group of like-minded people is essential when you leave the workplace. Why? Social connections create a sense of belonging, add meaning to life, and they provide support and keep stress levels in check. Being with others also creates opportunities to try new things and have someone to do it with, making it more fun! What are three social groups you could connect or reconnect with to remain socially active?

Any significant life change that alters your day to day routines, whether that be getting married, having kids or retiring, can throw any good habits you’ve set up out the window. So as you ponder what your retirement looks like, give some time to consider how you will remain, or even increase your fitness and health through food, exercise and movement. And don’t forget to think about your mental health! The Act Belong Commit program began from research at Curtin University and has some great ideas to get you started.

Choosing to retire looks different for everyone depending on your finances, mental preparation and interest in working. We’ll explore the different retirement methods you can consider as you approach this career stage.

For some, a staged approach to retirement brings the best of both worlds – a little income and a bit of freedom. This gradual phasing to becoming a retiree could look like rolling back from full-time to part-time or working shorter hours throughout the week. This ‘dipping your toes in the water approach’ is a great way to see if your retirement plans are thoroughly thought out before you take the big plunge.

Those with the opposite in mind choose a set date, work right up until that day and then that’s it for work! These individuals often have a large holiday or personal projects planned that they are looking forward to that will fill their time. This approach is commonly chosen by those in physically or mentally taxing jobs and allows them to feel immediate relief from those pressures.

Just because you’re considering retirement doesn’t mean you’ll lose the years of industry experience, corporate knowledge, and wisdom you’ve gained! Have a chat with your workplace (or even industry bodies) about mentoring for a new project or consulting for a short period to ensure that your knowledge is passed on. Just be sure to check with your financial advisor before agreeing to work about how potential income could affect your government benefits or superannuation payments.

I hope you enjoyed Part Seven: Preparing for Retirement and feel ready to make a decision about the right way to retire for you! If you’d like to discuss your retirement possibilities and what may best suit you, our hour-long Career Clarity sessions may be just what you are after. Or, if you know you’d love to continue consulting or mentoring, or perhaps even give time back through volunteering and need a resume that reflects a career’s worth of expertise, Elite would be happy to assist with a new resume.

This blog is the final instalment in a series about navigating the opportunities, potential pitfalls and changing priorities of planning and managing your career. See below for the other blogs in this series that you may find helpful for yourself or someone you know.

Part One: Finding Your First Job

Part Two: Applying for Graduate Positions

Part Three: Building a Successful Career

Part Four: Returning to Work After Parental Leave

Part Five: Navigating Career Change

We’ve been writing resumes and supporting clients Australia-wide since 2016, and we have a reputation for digging deep to distil a powerful value proposition for every client. Whether you are an executive in Brisbane, a public servant in Canberra, a Melbourne graduate seeking their first role, or an Australian Defence Partner based in Townsville, we’ve got you covered. We will unpack your professional story and help you approach your job search with CONFIDENCE.

We respectfully acknowledge the traditional custodians of the land upon which we live and work, the Ngunnawal people.

We acknowledge and respect their continuing culture and the contribution they make to the life of this city and this region, and extend that same respect to all Aboriginal and Torres Strait Islander people.